Resources

Four Reasons Your Nonprofit Might be Subjected to an Audit

Most of us worry about being subjected to an audit from time to time—after all, the IRS is known for

How new tax rules apply to your nonprofit’s donors

For most charitable contributions, the ability to qualify for a tax deduction hasn’t changed under the new tax rules introduced

Keep your nonprofit afloat with a leadership succession plan

If your top executive were to step down tomorrow, would your nonprofit be prepared with a clear leadership succession plan,

How nonprofits can take advantage of corporate volunteers

A strong corps of volunteers who operate within a robust volunteer program can be a huge help to many nonprofits.

Accounting for contributions and grants is now easier

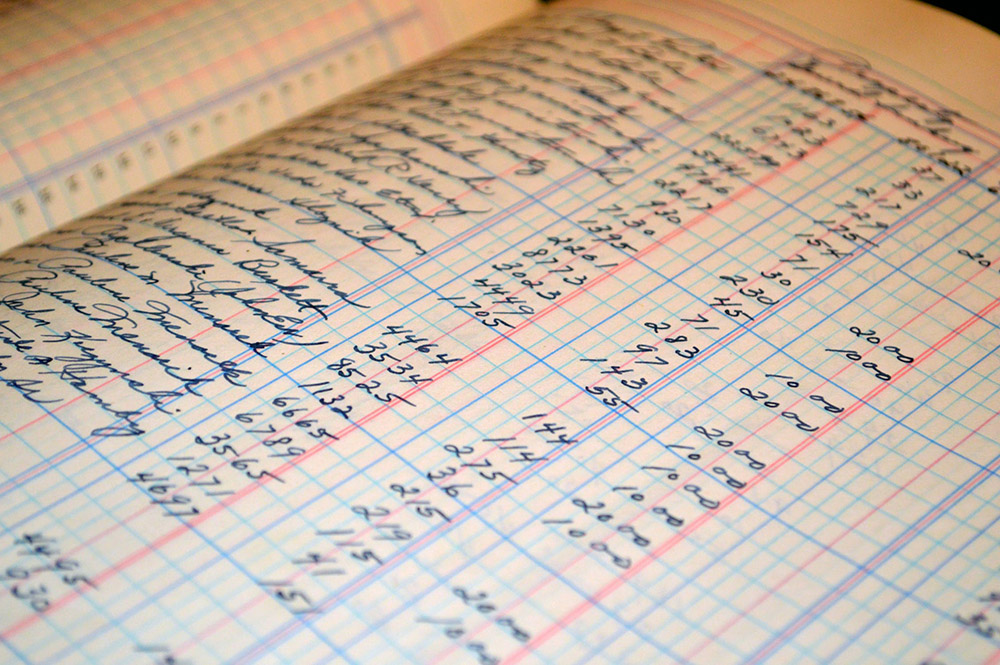

For many not-for-profits, it’s time to enlist the help of nonprofit audit services to get everything in order for end-of-the-quarter

Avoid excess benefit transactions and keep your exempt status

At the heart of every nonprofit organization is its mission, and a part of the fundamental financial scaffolding that helps

Engage supporters with your nonprofit’s annual report

Engage supporters early and often with your annual report. For many nonprofits, this multi-team project takes time, effort, and coordination—and

4 key metrics for evaluating your nonprofit’s finances

Do you know how to evaluate the use of your nonprofit’s funds and the target ranges for these metrics? Though

How cause marketing can help your nonprofit

As any provider of nonprofit audit services will tell you, diversified funding is essential. When your organization can rely on

How cross-training staff helps your nonprofit

In any organization, unexpected staffing shifts can disrupt operations—but in nonprofits the impact is often sharper because tightly interdependent, siloed

Educating your board members about fiduciary duties

Whether you compensate your nonprofit’s board or it’s made up of volunteer members, their position as trustees of your organization

Do “collective impact” initiative across organizations help your nonprofit expand its reach?

As not-for-profits taking on broader societal and cultural issues, such as income equality, access to healthcare, some are looking to

Selling Donors on Unrestricted Gifts

Many well-intentioned donors prefer “restricted” gifts earmarked for a specific program or initiative. Yet unrestricted gifts provide the flexibility nonprofits

Three tips for submitting a winning grant proposal

For many nonprofits, grant funding is essential—and securing it can be stressful given the high stakes and stiff competition. The

Four common pitfalls of nonprofit exempt status

A nonprofit’s tax exempt status is not a given once it is granted. Rather, it is an ongoing characterization that

The Benefits of Using a Business Mindset with Your Nonprofit

While nonprofits differ from for-profits in structure and purpose, both can learn from each other. For-profit leaders can adopt nonprofits’

What you need to know about D&O insurance for nonprofits

D&O insurance refers to directors and officers liability insurance and it is meant to mitigate the personal responsibility of certain

Board Members: 4 Financial Risk Indicators

One of the key responsibilities of a board is to monitor the nonprofit’s finances and guide the organization toward long-term